— Musings —11.14.2011 11:33 AM

Two charts to make one’s blood run cold

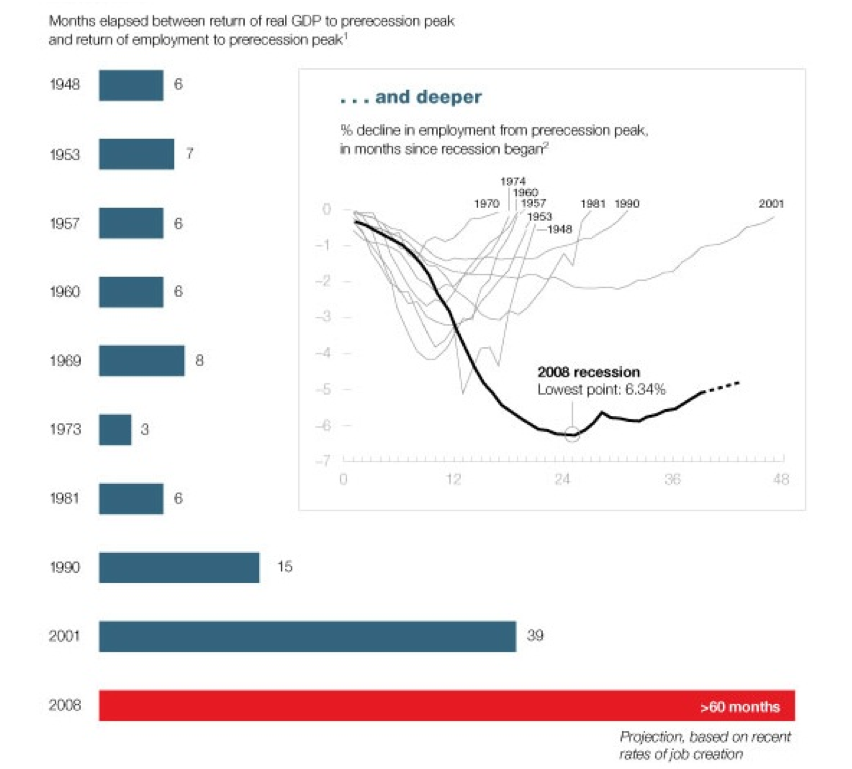

On the weekend, a fellow Obama fan asked me why I thought our guy may be hooped. I wish I had had this chart to share. It says it better than I did.

That’s not all, of course. If an economic horror of this scale starts to seep into Canada, Harper could be a goner, too. We shall see.

Yes, there are several variants of that chart, depending on whether you are looking at GDP or employment, but without doubt, the employment picture is the most scary. I could provide you with a few more that would make your hair stand on your head (for example, the average length of unemployment in the U.S.). This is the legacy of the financial crisis. However, your comment about something of this magnitude seeping into Canada — well it hasn’t. It contrast to the U.S., Canada’s recession was pretty much run of the mill and the recovery has been pretty much run-of-the mill as well. Canada’s job market is in fact in reasonably good shape.

And thank God for that. But the not-unreasonable question is, with the Eurozone collapsing, and the US continuing a downward slide, can Canada remain an island?

I wish it could, but I rather doubt it.

No it can’t remain an island. It wasn’t during the crisis either. The twist — in contrast to Europe — is that the domestic economy did not exhibit any of the excesses that we have seen in other countreies. So, we will get dragged down, but only because of our exposure to the U.S. and to a lesser extent, Europe.

“Without western Canadas exports and demographics eastern Canada would already be in crisis.”

So the obvious solution, as the Occupy protestors are suggesting, is to shut down the Oil Sands immediately 🙂

… and if if my auntie had two wheels she’d be a bicycle – please

Try this on:

“If the present government hadn’t cut the GST & Corporate tax rates we’d still be in surplus”

How bout:

“If W had not started 2 wars AND cut taxes AND deregulated the financial system the US would still be in surplus”

Or:

“If the US had not granted China MOST FAVOURED NATION status China would owe the US money”

Perhaps:

“If the Liberals had not given breaks to the tar sands or Ontario not invested in SUNCOR the TAR SANDS might not be able to afford to burn batteries to make our (more)toxic oil”

What about:

“If only Motcalm had stayed in the fort at Quebec, Canada would still be a French Colony”

That said, It’s a great time to to throw more people in jail though eh Gord? Those potheads are a serious impediment to our recovery.

Who cares what it costs & how much safer it’ll make us, take out the pitchforks and round’em up!

The timing is perfect- we wouldn’t want to be introducing ineffective billion-dollar legislation during ROUGH economic times- so may as well do it now.

Only a few people experience “GDP”.

A lot more people experience unemployment. Themselves, a friend, or a family member.

People aren’t reading the charts. They’re only reading the times.

And when they do, they sometimes don’t care who the other party is. The principle is if the situation sucks, you change.

Which could be a huge disaster if any of the lunatics in the Republican party takes over the White House. Remember, these guys think Bush was too liberal.

We’re about to get another dose of that soon…the bi-partisan super-committee is set to report on Nov 23rd. U.S. political gridlock is about to hit the radar screens again.

The only thing that is keeping British Columbia’s economy afloat these days(aside from the dope trade) is Asian money…..Chinese, Indian, and Korean……if not

for them the forest and mining industries in BC(the main drivers of our economy) would be hooped….thank goodness we’re on the Pacific Rim…..

If the Asian economies tank, and the US has not had a major recovery, look to see a lot more po’ folks in Lotus Land……

An interesting additional piece of information would be to compare each recession’s stimulus spending. This latest one had the biggest inflex of government cash associated with it and it didn’t seem to do any good. Arguments can be made without much difficulty that it made the problem worse.

Keynsians lose again.

Bush Sr was undone by a much milder recession that was over by the time he faced re-election, and in hindsight he was not a bad President. However, he ran against Clinton, the winner of a very competitive field of Democratic candidates and a superb politician in a campaign. The only real hope that Obama has is that the Republicans are doing nothing even close. Obama did not use the two years he had to start his Presidency well, and has not been effective enough truly to deserve a second term. But I suspect many American voters will view him as the better of a poor set of alternatives.

We shouldn’t be too smug about this in Canada. Some of the reasons we’ve avoided the worst of it are well-documented (our resource economy, high commodity prices, banking system/no bank bailouts, no subprime etc.). But beyond that, the length and severity of the unemployment problem, and the related issue of income inequality that’s come to the fore, are symptomatic of bigger issues in the labour market that are happening in all advanced economies, including ours. There are some really scary long-term labour market trends that are behind the “shrinking of the middle class” and some of the issues that the Occupy movement is publicizing. For example, the fact that now, more than ever, if you’re a male with no high school education, you are basically f*cked in this labour market. Being a male with no post-secondary education is especially perilous now, because the unskilled, manual-labour jobs that a lot of men in North America typically did and which used to pay a decent wage are now gone for good. There’s an excellent article about these broader trends in a recent edition of the Atlantic Monthly, “Can the Middle Class Be Saved?”. A bit of a dense read, but informative:

http://www.theatlantic.com/magazine/archive/2011/09/can-the-middle-class-be-saved/8600/

What I would like to know is where is all the deficit spending going? Obviously Canada is going to need jobs for Quebec and Ontario, and that should be HSR.

Gord, there is absolutely NO evidence that Obamacare is responsible for the slow pace of job creation. Companies responded to the recession this time around by dramatically cutting costs. As a result, profit margins have hit an all-time high. I pore through this data every day and believe me, that is one line of argumentation that just does not hold up. Really, you don’t need Obamacare to keep businesses cautious in this environment. Also, the pattern of job growth is much worse than previous recessions, but appears to be tracking the experience of financial-crisis induced recessions pretty well, based on other countries that have experienced credit crunches. This is not all that unusual. By the way, in case you are interested, there is a fair amount of research (go see the San Francisco Fed for example) suggesting that NAIRU has risen dramatically — some of the unemployment is becoming structural.

But is it a correlation or causation? I suspect the best you could do it the former…

As a labour economist, I agree entirely with Marc. As Marc correctly points out, there were/are far greater forces underwriting labour market trends, particularly in the US (i.e., credit market constraints). Indeed, Obamacare isn’t even an blip on the radar.

It is troubling that you, Gord, find causation in pretty pictures.

No it is NOT evidence. That is NOT how you build evidence in economics. Sorry.

Sorry to break this to you Gord, but I do know what I’m talking about. I’m an economist — that’s what I do for a living. Now, I decided to take a closer look at that chart, and the argument itself is completely bogus. Not only is it not evidence, it is outright wrong. A student that would have handed that in to me when I was teaching would have gotten a ZERO. Just take a good look at it. .The numbers on that chart are the monthly change in employment — the number of jobs created during the month. In every month from Feb 08 to Mar 10, the U.S. economy was LOSING JOBS. The economy started creating jobs in Mar 2010, and has created an average of 132.8K jobs per month since then. So, Gord, if you want to use that chart as evidence on the impact of Obamacare, you wopuld have to conclude that Obamacare is resonsible for the return of job creation in the U.S. from a period of pretty massive job losses. Exactly the Opposite point. So what does the guy do? He takes the change in the change in the number of jobs — the second derivative in math terms — and tries to build an argument around that. But that is ridiculous — and is in fact intellectually dishonest. The fact is that Obamacare was introduced at a point when the economy went from job losses to job creation. THAT is what the chart is telling you. Obviously, I would not make that argument. So much for “evidence”.